Gen Z is very skilled at making financial anxiety seem attractive. From “clean girl” to “dumpster-chic,” TikTok has become a platform for redefining not just how we live, but also how we spend or, more recently, how we don’t.

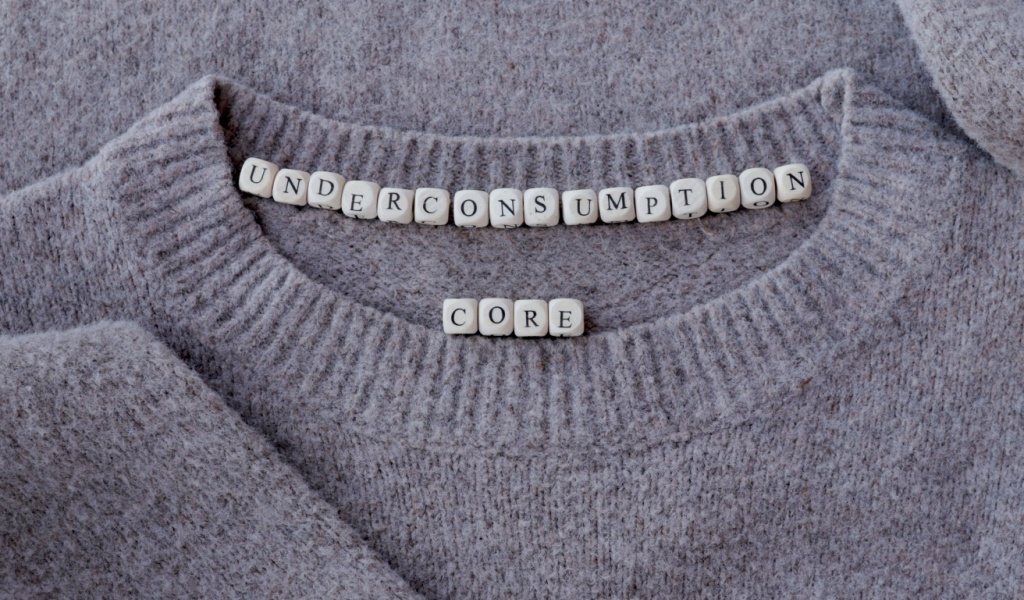

Introducing Underconsumption core, the newest internet sensation that’s less about buying into trends and more about rejecting them altogether.

If you’ve seen a video of someone happily using every last drop of moisturizer, wearing the same dress repeatedly, or repairing a broken watch instead of tossing it, welcome to the world of underconsumption core. It’s the art of intentional not-buying. Remarkably, it’s gaining popularity with Gen Z, a generation sinking into both content and increased living costs.

However, is it just another social media fad with a catchy name, or could it help Gen Z build real financial security?

What Is Underconsumption Core?

Fundamentally, underconsumption core is about using more of what you already have and consuming less. Whether it’s repairing your broken clock, skipping the newest trendy gadget, or finishing your makeup before replacing it, it’s a sensible move towards stretching your resources.

It’s a gentle push towards mindful financial practices and a rebellion against fast fashion and excessive consumption. Gen Z is redefining what “enough” means and letting go of the pressure to upgrade, refill, and repurchase constantly.

According to US News, it’s not just about saving money; it’s also about reducing clutter, resisting pressure, and getting creative with what you have!

Why Now?

Since Gen Z is broke and exhausted.

They’ve entered adulthood during a time of economic uncertainty. With inflation, housing costs, and job market volatility, it’s no surprise that lavish spending doesn’t feel empowering anymore. According to US News, this generation is more likely than other generations to say “no” to debt and reconsider what they need.

Underconsumption core isn’t only about saying no to things. It’s also about saying yes to implementing more breathing room, financially and mentally. And in a social media world that constantly encourages you to buy more, it feels revolutionary to simply not.

Is It Simply Another Trend?

Well, this is social media. Where there is a movement, there’s generally a monetized aesthetic that follows behind. Some people are using the underconsumption trend as a way to showcase their minimalism, with prudently curated TikTok videos that resemble an advertisement for a Scandinavian design catalog more than a genuine budgeting journey.

Critics claim that underconsumption core, like any other fad, can be performative. There’s also the risk of making the ones who genuinely need to spend feel guilty, particularly if they’re replacing broken necessities or investing in quality.

However, the intention behind this movement isn’t deprivation or perfection. It aims to help people make deliberate choices, ones that reflect their objectives and not their FYP.

Financial Advantages of Underconsumption Core

While some people may dismiss this trend as performative, the numbers say otherwise. Underconsumption can result in financial victories in the following ways:

- Smart Budgeting: Knowing what you have at home makes you spend less on duplicates (like the third tube of foundation you didn’t need).

- Less Impulse Spending: By pushing yourself to postpone purchases, you avoid the “quick dopamine hit” trap that results in buyer’s regret and budget sabotage.

- Mental Clarity owing to Reduced Clutter: A cleaner space makes it easier to concentrate on what matters, such as your goals, side hustles, and mental well-being.

- More Intentional Investments: Fewer treats make more space for saving and investing.

Additionally, underconsumption promotes resourcefulness. If you’re bored with your outfits, find new ways to style them, mix and match, or upcycle them. Not only does this help save money, but it also boosts confidence and creativity!

How to Make it Work in Real Life

If you’re interested in this lifestyle, here are some steps to follow:

- Make Use of what you have: Take a brief inventory of your restroom shelf, wardrobe, or pantry. You probably already have more than you realize.

- Implement a “wish list pause”: Make a list of things you want and wait for a month. If you still want it, go ahead and purchase it. If not, perhaps it wasn’t worth it.

- Celebrate small victories: Finished your old bottle of cream? Pat yourself on the back. Wore the same shoes all week? Now that’s a perfect example of underconsumption.

- Try a no-spend challenge: For a week or month, spend only on necessities, no new outfits, and no needless splurges.

- Thrift, trade, or borrow: If you want something, look for low-priced or free options first.

These practices build proper financial awareness, without turning your life into a reality show about frugality.

Fad or Solution?

Sure, underconsumption core seems like a trend. It has a name. It’s catchy and notable. If it walks like a duck, and such.

However, the habits behind it, such as using what you have, cutting down your spending, and redefining “enough,” aren’t new. They’re classic. And in a world where finances are worrying people, they might just be essential!

Is it the answer to all of Gen Z’s financial struggles? Probably not. But is it an innovative, sustainable tool that gives young adults a sense of control over their money and makes them less controlled by it? Absolutely.

In a digital world where every “must-have” product is just one swipe away, underconsumption core dares to say: What if they’re not?

And for Gen Z, these types of questions can be the most empowering fad of all!