New to budgeting? The envelope budgeting system may be a great way to start out because it is a simple and uncomplicated way to get your bills paid and money saved every single month. It is a popular method of budgeting among people because it helps you maintain a personal budget easily. With modern advancements, this budgeting method can be followed with the help of personal finance software as well!

How Does Envelope Budgeting Work?

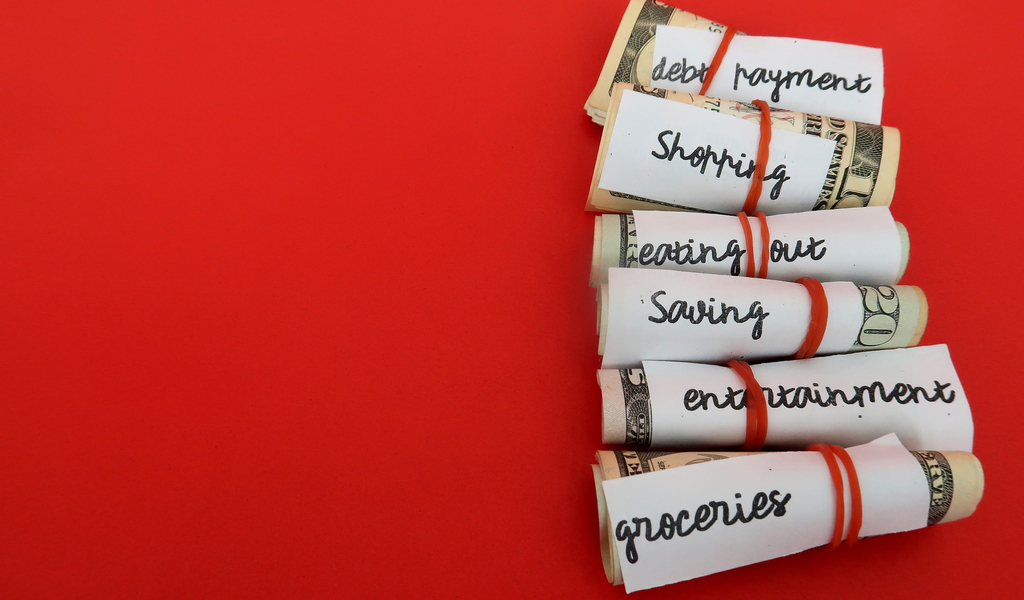

It is a very simple method to implement. As the name suggests, you are to place a predetermined amount of your income in different envelopes, each meant to spend on a category such as bills, groceries, gas, entertainment, and so on. You would have decided how much should be spent on each category and allocated an amount accordingly, and therefore, the idea is to spend only the amount in the envelope on expenses falling under the particular category. This is done with the intention of preventing overspending by limiting how much you can spend on each expense.

In today’s day and age, we are less likely to use cash, letting banks and other financial technology take care of our money. Nevertheless, you don’t have to use actual envelopes to follow this budget, you can make use of software or other technology as well.

The aim of envelope budgeting is to help you come to terms with your spending habits. Once the money in a particular “envelope” runs out, you can’t spend on that category anymore until your next salary check comes in.

Step 1. Establish Categories and Limits

The first step to establishing an envelope budget is to determine which categories of expenses you spend on in your day-to-day life and allocating a limit for each of them. Naturally, the total amount for all spending should not exceed your monthly incomes.

Everyone’s envelopes won’t be identical. You may have one category of spending which is higher than usual because of the circumstances that are unique to you and your budget must reflect that. To get an idea of what categories would be ideal for your budget, evaluate where your money goes currently.

Common expenditure includes groceries, utilities, rent, transportation, childcare costs, health and grooming, pet care, etc. Try to group similar expenses like electricity and water under one category named “utilities” to make sure it doesn’t get too overwhelming. Make sure to allocate money for irregular expenses such a taxes and insurance or things like gifts. Savings should be also an envelope that is given priority, given that your essential needs are adequately supported.

You can check bills or your recent banking statements to get an idea of how much you’re spending on each category currently. You can allocate that amount or a slightly smaller figure if you’re looking to reduce spending.

Step 2. Label Each Envelope

Once you have determined the categories that are to be included in your budget, you should write the name of each on separate envelopes along with the budgeted amount for it.

If you are paid weekly or bi-monthly, you can divide the monthly budgeted amount by the number of payments you will receive for that month. This divided amount can also be recorded on the envelope to make it clearer. This way, you know exactly how much should go into the envelope every time you receive a paycheck.

Step 3. Separate Funds

Now’s the time to put your money where your mouth is – that is, considering “mouth” as a metaphor for the envelopes. You’ve done all the preparations for starting your budget and it’s time to actually do it!

Cash your paycheck and separate the funds according to the categories you have predetermined. For example, you may have allocated $100 for the grocery envelope and $50 for the entertainment envelope.

In case you are paid more than once per month, you will add the divided amount into the envelopes every time a paycheck comes in. For expenses like rent and insurance which need to be paid at one go, you can use the full amount collected in this month’s envelope to pay at the beginning of the next month.

Step 4. Use Only the Money Left in the Envelopes

When you are paying for something, be it groceries or utilities, spend only from the money that is in that particular envelope. If you are going to the supermarket, carry the groceries envelope with you and spend only what is left in it.

In case the money from one of the envelopes runs out, do not supplement it with money from another! That defeats the purpose of this budgeting technique and also leaves you short of money for the other category of expense.

On the contrary, if you have money left over in one of the envelopes, you can leave it for next month’s spending or better yet, add it to your savings or emergency fund. This method of budgeting helps prioritize saving as well. If you find that you are repeatedly running out of money in one of the envelopes while there is leftover in another, you can amend the budgeted amounts going into the next month.

Envelope Budgeting with Financial Software

With modern technology at the helm of every part of our lives, including finance, you may wonder if using physical envelopes to budget is a practical idea – especially since most of us aren’t even paid in cash anymore. However, that doesn’t mean you can’t make use of the envelope budgeting method. In fact, it is actually easier than ever to manage thanks to financial software like You Need a Budget.

You Need a Budget is a personal finance software that helps you succeed at envelope budgeting. It uses virtual “envelopes” to represent the budget category and records all your spending activity and the balances in each category. When you record your income, the software automatically distributes the stipulated amounts into each “envelope”. When you spend money, you can input the amount spent and tell the software which category or “envelope” to deduct it from.

Bills or electronic fund transfers that are made directly are identified by the software, which then removes the paid amount from the appropriate envelope. In the case of credit card purchases that you make, the software deducts the amount to be allocated to the credit card payment “envelope” or category, meant to be used when you pay the bill for your credit card.